Why APS: Investors with Loss Making Background

Proven strategy & periodic review of investment in stock market is the key to success. We have noted either one of them or both were missing in any loss making stories in stock market investment. Broadly we have categorized such investors in two categories.

1. Inactive Investors:

This category of investors select few winning stocks in their portfolio and sleep. What appears a winning stock now is never guaranteed to be winning stock of future. For example see the following chart

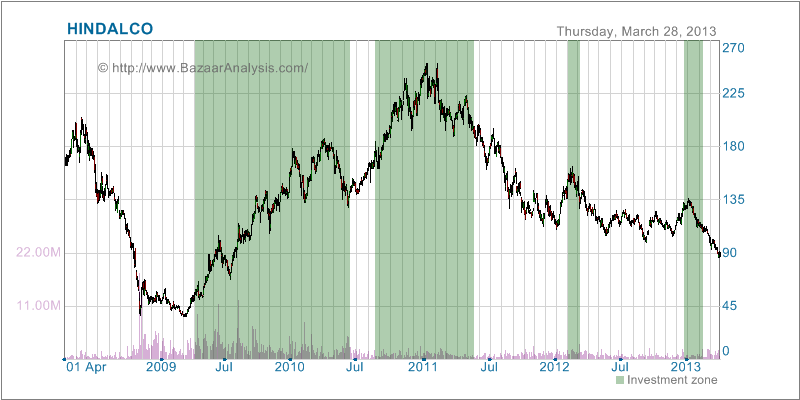

HINDALCO 5 Years Performance (Green shaded portion is showing the time zone when our APS system had invested in the stock)

Hindalco is a very good stock and it is part of top 50 stocks in the Indian stock market. Earlier two years in the above chart it has given extra ordinary returns while in the last two years it has given significant loss. So, even with very good stocks we need to be cautious and periodic review is very much needed.

For realizing how such approach could be disastrous read the following case studies which are based on real data

Case Studies

2. Active Investors:

This category of investors do not sleep and they put effort to strategies their investment plan. Reason behind their loss stories are either they have mis-interpreted (un-validated) strategy or their strategy is just to take dependency on third party strategy (which has not been validated or often considered a black box strategy).

As example, Diversification is known wisdom across most of the stock market investors. However, we have found, there is significant difference between just diversification and right diversification. An investor can buy one stock from each of the following sectors and can think he/she has diversified the portfolio.

- Textile

- Sugar

- Fertilizer

- Telecom

- Agriculture

- Tourism

- Media & Publishing

- Capital Goods

- Transport Services

- Consumer Durables

However, above portfolio is most likely to fail to reflect the magic of diversification. Reason, though they belong to distinct sectors, the weightage of all above sectors in overall stock market economy is less than 15%.

A real diversified portfolio should cover at least 80% of sectors in stock market with due weighted value. We have discussed more about such diversification strategy in the article at the following link.

Right Composition

In brief right composition of portfolio gives much better returns than regular fixed deposit and bonds.

Loss due to emotional reasons or third party borrowed stratagies has been summerized in the following three categories

| #1 | Following tips from unaccountable/short sighted source of information. Usually, they just give tips without knowing your current holding and never give timely alert to get out. Read the story of Ms. B.C.Lakshmi |  |

|---|---|---|

| #2 | Not accepting the loss making trade and convincing themselves as fundamental/long term player. Read the story of S.P.Tripathy & A.P.Sharma |  |

| #3 | Not accepting the loss making trade and trying to outsmart the market by averaging out. Read the story of A.V.Gupta |  |

How Does APS Mitigate the Issues Associated with Strategy & Review?

APS has broadly two sets of stratagies associated with investment. Details about the same is available at section Secret Behind. First strategy talks about how to select stocks and compose an ideal portfolio (see Rule-A & Rule-D at Secret Behind). Tool (Portfolio Builder) to compose an ideal portfolio and validate portfolio performance is available free on our website. Second part of the issue is review and how to review. We have formulated Rule-X for how to review and automated the process of review as paid service. Exact steps for for the same have been explained at the following link

How It Works

To see how APS performs against other alternatives please visit the following link

http://www.SafeTrade.in/ComparisonTables.aspx

How Can I Re-Build My Confidence?

We suggest that novice investors in the stock market to subscribe our trial package of three months and do virtual trading. It means you do not need to invest your actual money. Just enter the transactions in our system at suggested point of time for buy and sell. It keeps all records and shows the net result in terms of profit and loss on dash board. You may get confidence in a month, 3 months or even a year.

Conclusion: Most of the failure in stock market is due to lack of proven strategy or review. APS takes care of both issues and investors need to spend maximum of 15 minutes time in a week to manage their investment. APS also provides option to do virtual trading (also known as paper trading). Using virtual trading option, investors can gain confidence about APS system without investing real money in the market.

Did you like this article? Please share it with your social network