RGESS: Tax Benefit for First Time Stock Investors

Government of India has floated a scheme RGESS (Rajiv Gandhi Equity Saving Scheme) under which taxpayers can get tax benefit for investing in stock market. This benefit is in addition to regular deduction available u/s Sec 80C. This Scheme would give tax benefits to new investors who invest up to Rs. 50,000 (or Rs.1,50,000 across three consecutive years) and whose annual income is below Rs. 12 lakh. One of the conditions under this scheme is of lock-in for 3 years and stock must be selected from top 100 stocks listed on stock exchange. Details of this scheme is available at the following link.

http://rgess.com/

http://www.bseindia.com/rgess/

We compared the constraint imposed by the scheme and APS recommendations (Rule-ADX). First two rules are directly aligning with the constraints. Rule-A suggests to invest within top 500 companies while the scheme is asking to invest within top 100. Hence, scheme constraint is subset of Rule-A recommended set. Rule-D asks for diversity across various leading sectors and top 100 stocks have representation of all such sectors. Lock-in for three years is making more like our Spot scenario (Buy and hold for long period).

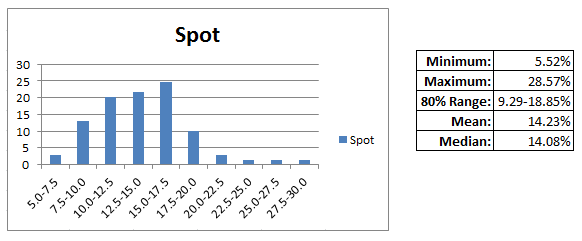

Our statistics based result (based on Portfolio Builder) suggests such strategy on an average, returns 14% annual profit (80% investors in range of 9 to 19%) for BSE 500 stocks if held for 5 years.

Return on Investment (CAGR) Pattern for Stocks Selected According to Rule-D and Investor held the Stocks for Next 5 Years (Scope: BSE500)

For NIFTY 50 again this result is almost very close, so, we assume the result for top100 stocks should be the same.

http://www.safetrade.in/NiftyAndAPS.aspx

Our assumption is that the investor is in higher bracket of the income and paying 30% tax for any additional income. If such person is investing Rs.50,000 in stock market under RGESS scheme. Rs.25,000 (50% of invested value) of his/her investment will attract tax benefit which will be equivalent to Rs.7,500. Effectively the person is forking out Rs.42,500 for investment and using which buys Rs.50,000 worth stocks. Assuming his/her return will fall in 80% scenario of Spot return then following will be the potential range of his investment value down the three years.

| Minimum | Median | Maximum | |

|---|---|---|---|

| Money Multiplication factor (In 3 years) | 1.295(9% p.a) | 1.480(14% p.a) | 1.685(19% p.a) |

Keeping in mind, your actual investment was just Rs.42,500 then it will improve the Money Multiplication factor (divide each number by 0.85)

| Minimum | Median | Maximum | |

|---|---|---|---|

| Money Multiplication factor (In 3 years) | 1.524 (15.1% p.a) | 1.740(20.3% p.a) | 1.980(25.6% p.a) |

So, effectively investors are going to get interest on their money in the range of 15.1 to 25.6% (median 20.3% and chance to be in this range is 80%)

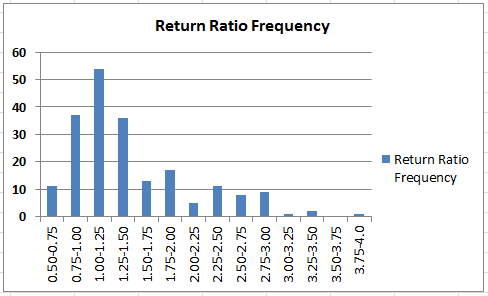

We validated our result with raw data of 20 years NIFTY value. Assume 1st March 1993 as starting point and start such investment batch every month. First batch completed 3 years (lock-in) on 1st March 1996. Hence, in the next 17 years we have a total of 205 such batches of investment. Following graph is showing return ratio (value at the end of 3 year/value at the beginning of the batch) of such investment batches.

Nifty 3 Year Return Ratio Across Last 20 Years(Distribution)

Median Ratio: 1.256 (equivalent to 13.9% return after tax benefit)

80% Range: 0.86 to 2.50 (equivalent to 0% to 43% return)

Chances to make loss: 9%

Maximum loss: 9% (During March 2000 to March 2003)

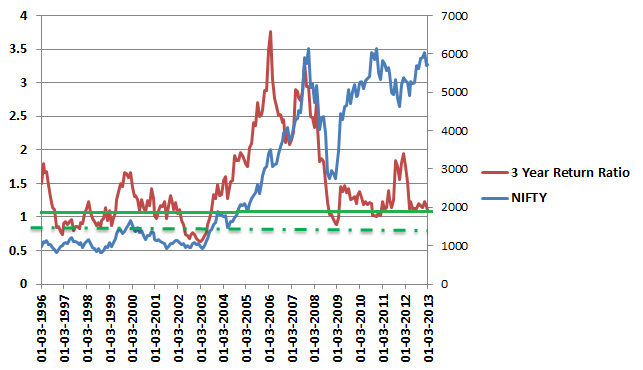

Following graph is showing alternative way to look at the same data. Instances when Return Ratio line (red line) has gone below green dash line are only when investors have lost money otherwise everywhere they have made profit. Instances which are above solid green lines have beaten return from fixed deposit (post tax).

Nifty 3 Year Return Ratio Across Last 20 Years(Timeline)

A portfolio diversified using Rule-D has improved median return ratio (1.48) and 80% range is narrow (1.295 to 1.685). It has capped down chances of making profit beyond return ratio of 1.685 (25.6% p.a) however it has also capped down the lower end profit range to 1.295 (15.1% p.a).

Now, coming to alternative options, let us assume investor invested the money in fixed deposit. In this case investor will lose Rs.7,500 (the benefit RGESS was giving upfront) tax benefit and will remain with Rs.42,500 for investment. Assuming the investor got very good deal of return of 9.5% (FD). In such scenario, Rs.42,500 will become Rs.55,800 in three years. On fixed deposit interest one has to pay 30% tax on the interest. 30% of 13,300 (55,800 – 42,500) is Rs.3990. So, net return is Rs.51,810. This is equivalent to 6.6% annual return. Matching with RGESS scheme return it is less than half of bottom 10%* and less than 1/3rd of median investors under RGESS scheme.

We also analysed another scenario where person would like to invest in tax saving mutual fund (commonly known as ELSS) to bypass the tax. This case is not exactly overlapping with RGESS case because tax saving mutual funds comes under u/s 80C while RGESS is beyond that. Still, we analysed the performance of tax saving mutual funds and RGESS (with right diversity). From available data on valueresearchonline.com (31st July 2013) we found median return of funds under this category is -0.6% per annum and 80% funds are in range of -1.74 to 3.79%**. Value of investment of Rs.1,00,000 , 3 years back is in the range of Rs. 94,870 to Rs.1,11,800 (median Rs. 98,200). Do we really need to calculate further? In brief even after paying tax at both ends (before investing and after receiving interest) in more than 70% cases fixed deposit is better bet than locking money with such inefficient funds. In other words FD is much better than ELSS (Equity linked saving scheme) and RGESS is above to all.

At the beginning total one time investment if Rs.1,00,000 was permitted under this scheme. Recent change has allowed to invest Rs.1,50,000 across three years (Rs.50,000 each consecutive year). This change has more positive impact on the investment as market risk get spread across time. We did a calculation based on Sensex performance and assumed investor has invested Rs.50,000 three consecutive years and withdrawal the money on completion of fifth year. Our calculation is suggesting median return of such investment has yield 15% year on year and in more than 90% case it has yielded more than 12% (tax free)

RGESS Return On Investment in 3 Years Scenario

Median return has just improved by around 1%, if we compare it with single time investment for 3 years return ratio. However, we can see this time loss has not been registered which was around 10% of the time in single investment case. Hence, investment spread across three years has further impacted us positively.

Conclusion: RGESS is very good opportunity to get exposure to stock market for first timer (only applicable to Indian tax payers). In a way govt. is giving 15% cushion upfront for covering potential loss in the market. This support is improving chances for investors to make profit by more than 90% and in 75% investors are most likely to beat fixed deposit return.

A Portfolio formed using Rule-D has further reduced the risk zone and result is showing in more than 90% cases such investors will enjoy more than 15% return on their investment after tax benefit.

If an investor chose to invest continuous 3 years in a row then chances of loss drop down to zero and median return is more than 15% year on year (tax free). Hence, one should not miss this opportunity to save tax and enter in market at theoratically zero risk.

* We have covered 80% range. So, only 10% are below minimum, rest 10% are above maximum value

**Click here to see ELSS Funds Return in last 3 years