Following case studies have all fictitious charecter. However, name of the stocks

and their price in given time frame are correct. These case stidies have purpose

to illustrate how a alert based system can help investors in cutting unwanted loss

as well as prviding hint for entry point.

Case Studies

Protection Scenarios

Protection Scenarios

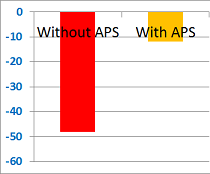

Scenario 1: Mr. Murthy is a retired officer from a PSU. After retirement

(Oct.2010) he invested some part of his money in equity market. As safe guard he

chose only blue chip companies' stocks. After one year he reviewed his portfolio

and to his surprise he had lost more than 48% in some of the stocks (like L&T).

Mr. Murthy neither likes to visit stock market regularly nor to lose wealth by depositing

in fixed deposit (Inflation is higher than interest rate). He is also skeptical

about mutual funds as more than 70% of them fail to beat regular index and for underperformance,

they charge upto 3% net management fees apart from entry/exit load.

|

APS

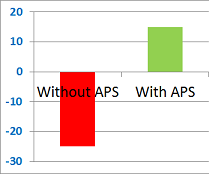

Solution:Mr. Murthy subscribed APS and did entry of all his transactions

including L&T at buy price ₹1300. APS gave him pink alert on Jan. 7, 2011

and red alert on Jan. 14, 2011. He sold the stock at ₹1140 on red alert.

Hence, he incurred loss of around 12%. He saved further erosion of 36% (Remember

he has lost more than 48% without APS) of his investment money.

|

|

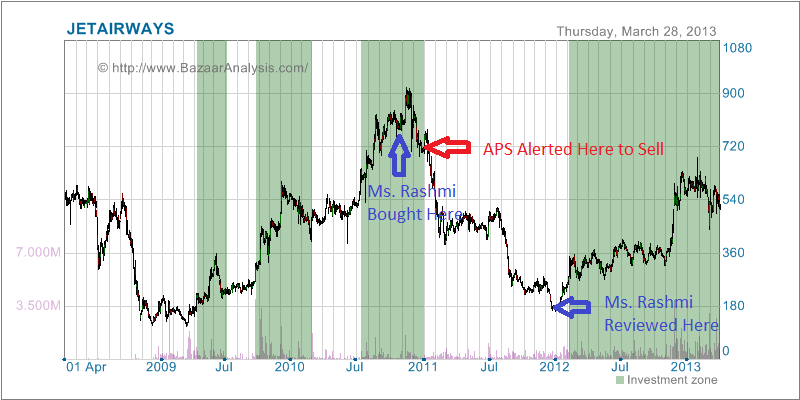

Scenario 2: Ms. Rashmi Goyal is a software professional and working

for a consulting company which has customers across the globe. During 2010 Deepawali

muhurat trading she invested her received bonus of the year in companies which were

doing well and the ones which were established leaders in their segment. Next one

year she was busy at client site and working in different geographical clock time.

She found time to review her portfolio only next year during Christmas vacation.

To her surprise she had lost more than 75% in some of the stocks (like Jet Airways)

during the same time. She had made profit in many of the stocks but few stocks which

went bad ate away most of the profit. Even if she would have

reviewed her portfolio once in between that would have made big difference in final

figure. But, question was how and when? She is perplexed.

|

APS

Solution: Ms. Rashmi subscribed APS and registered all her transactions

in the APS system. She bought Jet Airways at average buy price ₹ 800. APS

gave her pink alert on Dec. 30, 2010 and red alert on Jan. 18, 2011. At red alert

she sold of the stock at price ₹625. She incured loss of 22%. She saved further

erosion of 53% (Remember she lost more than 75% without APS) of her investment

money.

|

|

Profit Scenarios

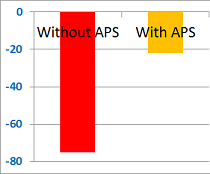

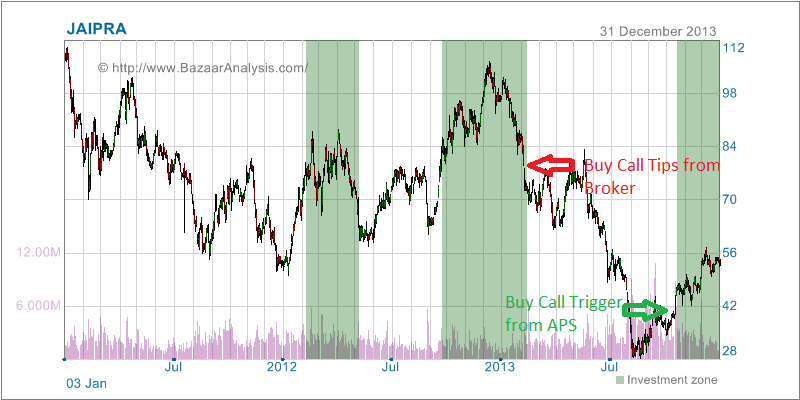

Scenario 3: Mr. Ankit Shah is in business of diamond cutting and

polishing. He also invests in stock market but he is too busy to analyse stocks himself.

Often he invests according to tips provided by his broker. In the first week of

February 2013 he got one call from his broker to buy JP Associates. 'This is NIFTY

stock and it has sound fundamental' was justification of the broker. At this moment this stock is available

at very cheap price (Rs. 75). Mr. Shah invested significant amount of his money on this stock.

At end of the year 2013 the stock was trading at Rs.55.

Noticeable data point is the stock has doubled its price in last 5 months. However, Mr. Shah is still

in loss of 25%.

|

APS

Solution:Mr. Shah has subscribed APS. He registered JP Associate in his

portfolio (without actual buying) after getting tips from his broker. APS weekly

report on 18 Oct.2013 alerted him for buying opportunity. He bought the stock

next day at Rs.47. At end of the year he is with 15% profit for just 2 and

half months investment (rest 8 and half months his money was earning saving account

interest). He knows APS is watching his investment and it will alert for any change

in trend at appropriate time. So, he has nothing to worry about.

|

|

Scenario 4: Ipsita Ray is a budding actress. In the past she invested

her surplus income in

many business on personal approach basis. Unfortunately she had bad

experience of getting cheated most of the time. Apart from her busy schedule she has no penchant

for mathematics to calculate and analyse her finances. She knows stock market

is the ultimate investment vehicle but the question is how to ride that?

APS

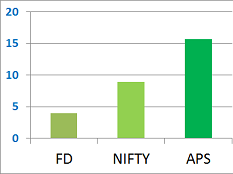

Solution: Ipsita came to know about APS in August 2013. She invested Rs.100000

on trial basis in stock market by help of Auto Suggestion feature

of APS. Her first transaction date was 08 Aug. 2013. She just followed weekly instructions

provided by APS. It was just like checking her email and Facebook accounts. In six

months duration she has earned more than 15% interest on her investment. This is

better than market index (NIFTY) growth 9% and much better than fixed deposit return of

4%.

Total engagement instances are 8 times in 6 months. It was only once in a month.

|

Time Period: 6 Months

Time Period: 6 Months

|

Ipsita's portfolio snapshot down the 6 months

+Show Transactions Details

-Hide Transactions Details

|

Date

|

Stock

|

Price

|

Stock Buy

|

Stock Sell

|

Transaction Value

|

Cash

|

|

06-08-2013

|

|

|

|

|

|

100000.00

|

|

06-08-2013

|

DABUR INDIA LTD

|

160.00

|

62

|

|

-9920.00

|

90080.00

|

|

06-08-2013

|

HDFC BANK LTD.

|

607.75

|

16

|

|

-9724.00

|

80356.00

|

|

06-08-2013

|

HERO MOTOCORP LIMITED

|

1848.65

|

5

|

|

-9243.25

|

71112.75

|

|

06-08-2013

|

INFOSYS LTD

|

2986.10

|

3

|

|

-8958.30

|

62154.45

|

|

06-08-2013

|

BRITANNIA INDUSTRIES LTD.

|

722.75

|

14

|

|

-10118.50

|

52035.95

|

|

06-08-2013

|

BIOCON LTD.

|

318.85

|

31

|

|

-9884.35

|

42151.60

|

|

06-08-2013

|

CAIRN INDIA LIMITED

|

289.80

|

35

|

|

-10143.00

|

32008.60

|

|

25-09-2013

|

MANAPPURAM FINANCE LIMITED

|

14.90

|

694

|

|

-10340.60

|

21668.00

|

|

13-11-2013

|

BRITANNIA INDUSTRIES LTD.

|

891.25

|

|

2

|

1782.50

|

23450.50

|

|

06-01-2014

|

BIOCON LTD.

|

481.15

|

|

7

|

3368.05

|

26818.55

|

|

13-01-2014

|

MANAPPURAM FINANCE LIMITED

|

20.55

|

|

125

|

2568.75

|

29387.30

|

|

13-01-2014

|

GEOMETRIC LTD

|

100.30

|

113

|

|

-11333.90

|

18053.40

|

|

13-01-2014

|

SHRIRAM-CITY UNION FINANCE LTD.

|

1046.50

|

11

|

|

-11511.50

|

6541.90

|

|

24-01-2014

|

CAIRN INDIA LIMITED

|

325.40

|

|

35

|

11389.00

|

17930.90

|

|

07-02-2014

|

SHRIRAM-CITY UNION FINANCE LTD.

|

977.00

|

|

11

|

10747.00

|

28677.90

|

|

11-02-2014

|

MANAPPURAM FINANCE LIMITED

|

23.85

|

|

83

|

1979.55

|

30657.45

|

Conclusion:

Conclusion:

APS works as watch dog for investors who have taken exposure in stock market. It

alerts on moment when stock start sliding down confirmed by statistical evidence.

It also works as help to new investors in identifying right stocks and building

balanced portfolio. It provides alert in buy direction too. Investors receive alert

for a stocks registered in their portfolio when it starts moving upward.